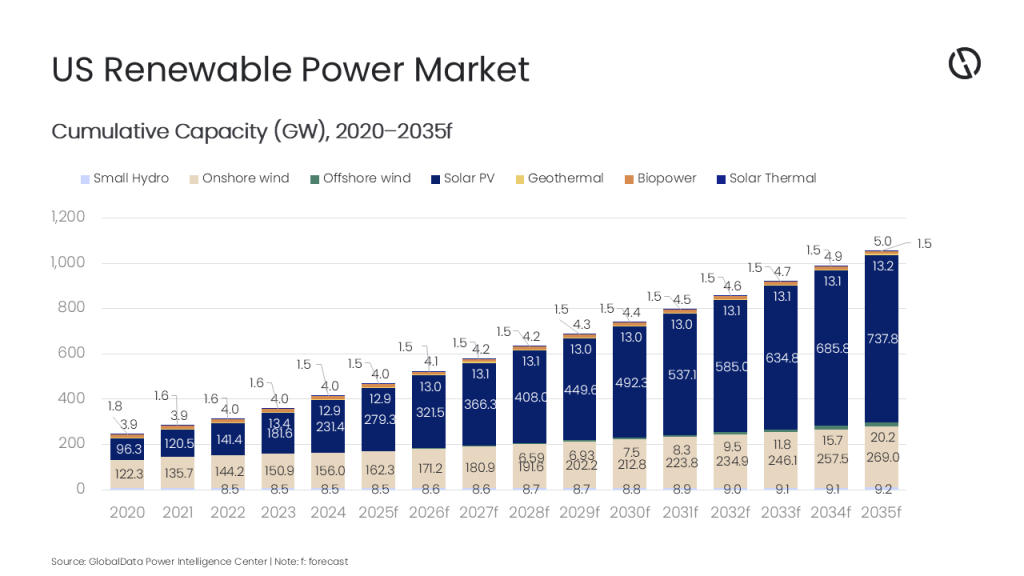

Renewable power capacity in the United States is set to reach around 1.06 TW by 2035, up from around 414.5 GW in 2024, despite a recent pushback against renewables by the federal government, GlobalData has said.

According to GlobalData, long-term investment in energy generation is being driven by state-level clean energy mandates, utility procurement programmes, and private sector demand, with renewable energy remaining the ‘dominant source’ of new capacity additions.

Solar and wind

As it noted, installed solar capacity in the US is projected to increase from around 231.4 GW in 2024 to approximately 737.8 GW by 2035, with Texas, California and the Midwest leading the way in terms of development, while onshore wind capacity is set to rise from around 156 GW in 2024 to nearly 269 GW by 2035.

The offshore wind sector, however, faced repeated policy and regulatory disruptions during 2025, with the Trump administration announcing the suspension of five offshore wind projects amid national security concerns. This means that large-scale wind projects along the Atlantic seaboard, including Vineyard Wind, Revolution Wind, Coastal Virginia Offshore Wind, Sunrise Wind, and Empire Wind, are currently on hold.

Aside from renewables, natural gas is also likely to remain a key part of the US’s energy mix, with capacity projected to rise from around 573.1 GW in 2024 to approximately 620.9 GW by 2035, while nuclear capacity will rise from 97 GW to around 102 GW over the same period.

Coal and oil-fired capacity is set to decline, however, as ageing power plants are decommissioned.

‘Large-scale investment’

“The US power sector continues to attract large-scale investment in renewables, supported primarily by state-level clean energy mandates, long-term utility procurement programs, and sustained corporate power purchase agreement activity,” commented Mohammed Ziauddin, power analyst at GlobalData.

“Between 2025-2030, renewable investment is expected to reach around $442.2 billion, reflecting the scale of ongoing solar and wind development across key regional markets. At the same time, continued investment in natural gas and nuclear capacity reflects broader federal and state priorities around domestic fuel availability, industrial growth, and long-term capacity adequacy, including life extensions, and advanced nuclear development.”

Ziauddin added that despite policy shifts and tariff-related cost pressures, the renewable energy sector will remain the “primary driver” of capacity growth in the US power network, supported by state policies and private-sector demand.

“Together, these trends are reshaping the US electricity system into a more diversified and resilient market over the long term,” he said. Read more here.