A third of data centres operating in the United States could be fully self-sufficient in their energy needs by the end of the decade, a new study by Bloom Energy has suggested.

Bloom Energy’s Data Center Power Report, which surveyed decision-makers across the data centre ecosystem, found that as more ‘gigawatt-scale’ data centres come online, developers are reducing their reliance on the electricity grid, and investing more in on-site electricity generation.

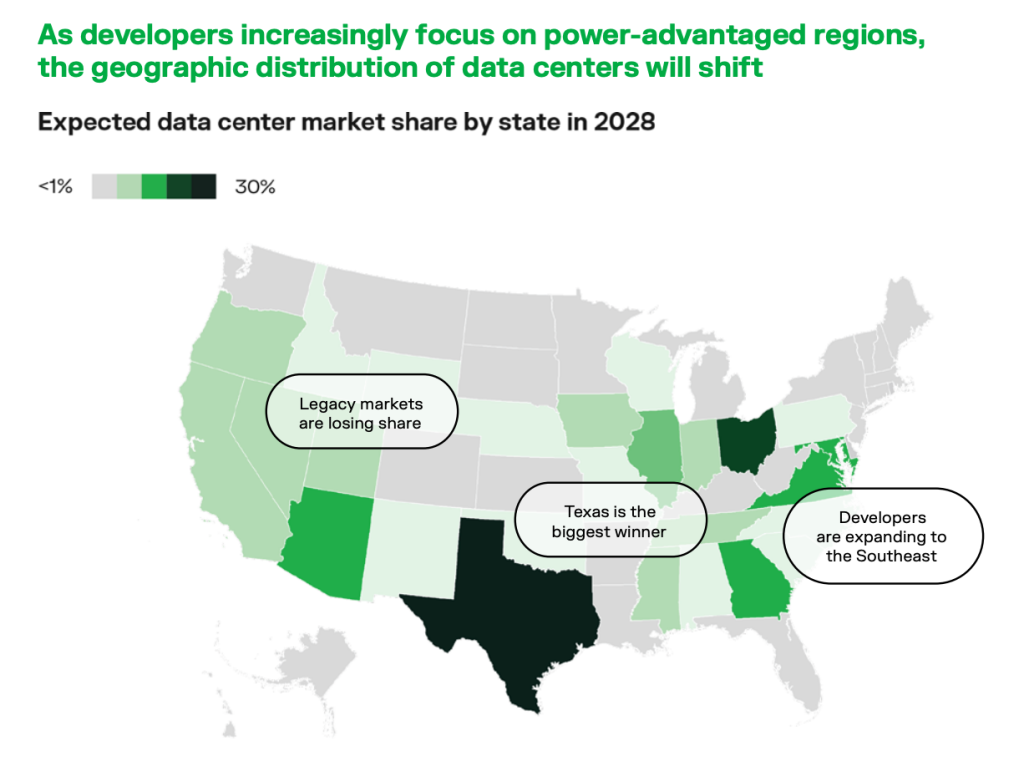

This, in turn, is influencing the geographical spread of data centres, with increased focus on power-advantaged regions – Texas, which is expected to capture around 30% of US data centre market share by 2028, is the big winner, while Georgia’s share is expected to almost double, from 4% of the total data centre market, to 7%.

At the same time, California, Oregon, Iowa, and Nebraska are likely to see a drop in their relative market share.

Independent of the grid

“Data centre and AI factory developers can’t afford delays,” commented Natalie Sunderland, Bloom Energy’s chief marketing officer. “Our analysis and survey results show that they’re moving into power‑advantaged regions where capacity can be secured faster – and increasingly designing campuses to operate independently of the grid.

“The surge in AI demand creates a clear opportunity for states that can adapt to support large-scale AI deployments at speed.”

More than half of new data centre campuses are expected to exceed 500 MW by 2035, while close to a third are predicted to exceed 1 GW – each of which will consume approximately as much electricity as the city of San Francisco.

Development timelines

As such, onsite power generation will not only be a pre-requisite for data centre facilities, it will also help to minimise development timelines and costs. In a separate report six months ago, just over 10% of data centre developers anticipated using 100% on-site power by 2030 – this has now risen to a third.

In addition, higher‑voltage and DC electrical architectures are ‘moving from roadmap to reality’, the study noted, with 45% of respondents expecting to have adopted DC distribution architectures in their new data centres by 2028.

‘Challenges and obstacles certainly exist, but the industry’s trajectory is clear – people will keep scaling

data centres as far and as fast as they can,’ the report noted.

Bloom Energy’s study surveyed 152 decision-makers across the data centre power ecosystem in November 2025, including hyperscalers, colocation developers, utilities, and GPU service providers. Read more here.